How to Leverage Survey Data For Lead Generation

Quick Summary: Surveys are a valuable marketing tool that help businesses understand their audience and inform their strategies. By designing effective surveys, targeting the right audience, and crafting clear questions, companies can gather actionable insights. Analyzing survey data, both quantitative and qualitative, allows businesses to generate high-quality leads and tailor marketing campaigns for higher conversion rates.

Surveys are a powerful marketing tool that provides valuable insight and can be used to better get to know an audience and conduct research for a product or project. Surveys can help you obtain valuable information about your current or potential customers to help inform your marketing messages, strategies, and campaigns. But how does the information gained from a survey translate into more qualified leads and higher conversion rates with your target market? Let’s dive in and find out!

Designing Lead Generation Surveys For Effective Analysis

Before we can dive into the analysis of survey data, we must first understand how to create a survey that will effectively gain higher survey response rates and the high-quality leads we are looking for in your target market.

Here are five key steps to follow when designing a survey:

- Define clear objectives: Ask yourself “What is the purpose of this survey? What information are we trying to gather and how will it gain potential leads?” The research questions that come from this, will be what guide your questions, organize them and analyze them.

- Target the right audience: Your survey won’t achieve your goals if you’re not reaching the right audience. But how do you find the right audience? Tailor your questions to the demographics and interests of your target audience. For example, HVAC company wants to know the needs and preferences of homeowners regarding their HVAC services. They may ask questions such as the following:

- “How often do you schedule maintenance for your HVAC system?”

- “What are the most important factors you consider when choosing an HVAC maintenance service provider?”

- Craft clear and concise questions: Avoid being vague and be sure the questions are easy for a reader to digest, there should be no confusion for the participant. Use simple language and avoid leading questions, as they can taint your data. During this process be sure to note which questions are the most important to receive answers to.

- Mix question types: Utilizing the different types of questions such as multiple choice, rating scales, open-ended and ranking questions will help you collect both qualitative and quantitative data.

- Test the survey: Prior to launching the survey, test it with a small group to weed out issues and find areas to improve.

The Importance of Crafting Great Survey Questions

It is important to consider things such as question wording, type, length, and order when designing the lead generation survey for your target audience. All of these things will help to get a participant to complete the entire survey, and not skip out early without finishing.

When crafting great survey questions, your focus should be not only on gathering useful data but also on maintaining the participant’s interest and cooperation throughout the survey.

Let’s explore why each of these elements is crucial:

1. Wording Matters

Survey questions should be straightforward and devoid of jargon. Complex terms or ambiguous phrasing can confuse participants and lead to inaccurate responses. For instance, instead of asking, “What is your perception of our HVAC service offerings?” consider a clearer approach: “How satisfied are you with our HVAC services?” This kind of language is more approachable and easier for respondents to understand, increasing the likelihood of thoughtful and honest answers.

2. Question Types

Incorporating different types of questions—such as multiple-choice, Likert scales, and open-ended responses—can enhance the lead generation survey experience. Multiple-choice questions allow for quick, quantifiable answers, while open-ended questions encourage participants to share their insights and opinions in their own words. This variety engages respondents and allows you to collect richer, more nuanced data. For example, asking, “What improvements would you like to see in our HVAC services?” invites personalized feedback that can lead to deeper insights.

3. Length Considerations

The length of your survey can significantly impact response rates and the quality of data collected. Shorter surveys tend to receive higher completion rates, while longer surveys may lead to participant fatigue and careless responses. Aim to keep your survey concise—generally, 5 to 10 minutes is an ideal target. When constructing your survey, prioritize essential questions to ensure that each one serves a clear purpose in your data collection strategy. If you find you have too many questions, consider whether some can be combined or eliminated.

Survey Question Wording & Its Importance

There are a few ways to ensure you do not confuse participants when it comes to the wording of your questions.

Avoid leading words/questions as they can create a bias for participants.

Example question: “How satisfied are you with our top-rated service?”

This is guiding the participant towards a particular way of responding. A better way to word this would be “How satisfied are you with our service?” and give the following choices: Very Satisfied/Satisfied/Neutral/Dissatisfied/Very Dissatisfied.

Be sure to include mutually exclusive choices. A good example of this is when asking questions regarding age.

Example question: “What is your age group?” and the choices are the following:

- 20-30

- 30-40

- 40-50

- 50-60

How would a participant who is 30, 40, or 50 answer this question? A better way to frame the choices would be:

- 20-29

- 30-39

- 40-49

- 50-59

When crafting survey questions, be direct and clear. The more vague a question is, the more likely the answers will be all across the board. You want your participants to know exactly what you are asking.

Example question: “How do you feel about our service?”

This question is too broad and does not specify which aspect of services you are asking about, for example customer service, pricing, product, etc.

Exhaust all possible answer options. Failing to cover all options will cause participants to lean towards answering “other,” which can mean a lot of things.

Example question: “Why did you choose our services?

- Price

- Reputation

- Recommendation from a friend

- Other”

What is missing from the choices? Important factors like location, availability of services, previous experience, and special promotions should be included to better understand why participants chose your services. While it’s crucial to offer an “other” option, it’s equally important to provide a text box for respondents to specify their answer. This ensures clarity and helps you gather more precise feedback.

The art of crafting survey questions takes patience and practice. That’s why testing the survey prior to launch is important. You are able to ask participants of the pilot survey specific questions about their understanding of the questions and their answer choices.

Required Survey Questions: Do’s & Don’ts

Another consideration when crafting survey questions is whether or not to make a question “required.” Remember when we discussed which questions are the most important in the survey? Those questions most definitely need to be required.

You may be thinking, don’t I want all of my questions to be answered? This is a valid question and concern. However, there are a few things to consider when making a question. For example, if you ask someone “How long have you owned your home?” If you require this question, and the survey participant is a renter, they are likely to not answer the question at all. Because this is a “required” question of the survey, the survey will not be able to be submitted. Therefore, that is one less completed survey, losing valuable data. Another issue with this is, what if they are a renter, and in order to get the survey completed, they respond “yes” to this question? If this is the case, now the data is tainted with an untrue response and the person analyzing the data does not know, and will treat this to be true, though in reality it is false.

However, there are certain questions you will want to make required. These include questions collecting the following information from participants:

1. Demographic Information

Understanding who your participants are is crucial for segmenting your audience later on. Required demographic questions should include:

- Age: Helps you understand the age group’s preferences, purchasing decisions, and buying power.

- Gender: Vital for tailoring your marketing messages to different segments.

- Location: Geographic data can help in local marketing efforts and understanding regional differences.

2. Contact Details

If your goal is to convert survey responses into potential leads, you’ll need to ask for contact information. Make sure to require:

- Email Address: The most common method for lead generation; also, a way to send follow-up information or offers.

- Phone Number: While not always necessary, in some cases, having a number can facilitate direct follow-up for high-value leads.

Types of Survey Questions & When to Use Each

The type of survey question you choose is determined by the information you are seeking, your audience, and how you plan to analyze your data. There are several types of survey questions and each has its own purpose for your survey.

Multiple Choice Questions ask participants to select one or more option from a predefined list. This question type is used to quantify responses and allow for simple analysis and comparison.

Example: What is your age?

- Under 18

- 18-24

- 25-34

- 35-44

- 45-54

- 55-64

- 65 and over

Rating Scale Questions measure the intensity of opinions, attitudes or behaviors. These questions offer answer choices that indicate the respondents level of agreement, satisfaction, frequency or other relevant factors.

Example: How likely are you to recommend our services to a friend or family member?

Likert Scale Questions gauge attitudes and opinions across the range of a spectrum.

Example: I was satisfied with my AC installation services.

- Strongly agree

- Agree

- Neutral

- Disagree

- Strongly disagree

Matrix Questions evaluate multiple items using the same set of likert or rating scaled responses.

Example:

Dropdown Questions provide a list of options in a compact dropdown menu format.

Example:

Open-ended Questions collect detailed responses written by survey participants.

Example: “What improvements could we make to our AC installation services?

Please provide answer here: (answer box)

Ranking questions provide understanding to the respondents preferences and their relative importance.

Example:

Image Choice Questions allow you to provide images for the respondents to evaluate.

Click Map Questions allow you to receive real-time feedback on an image. These questions allow you to provide an image for respondents

File Upload Questions allow survey respondents to upload their own files.

Example: “Please upload a photo of your current HVAC system setup for our technicians to review before your appointment.”

Slider Questions provide respondents with a numerical scale to choose from x to y how a respondent feels about a question.

Choosing the right type of question can determine whether a respondent is able to thoroughly understand the question correctly and their likelihood of answering it. Therefor, being thoughtful with the language of your question can only get you so far, the type of question chosen helps take you to the finish line when crafting survey questions.

Organizing Survey Questions

Now that you have your questions written and crafted, it is important to organize them and put them into the appropriate buckets. This is done by determining which questions address which of your research questions and objectives. A great way to organize this is with a visual table.

By organizing your questions into these buckets, not only are you able to easily see how each question serves your objectives, but this will make analyzing your data much easier later on.

Quantitative vs. Qualitative Data

The two main types of data when referring to survey analysis are quantitative and qualitative. According to West Virginia University, quantitative research “Uses statistical methods to test strength and significance of relationships,” while qualitative research “Seeks to provide understanding of experience, perceptions, motivations, intentions, and behaviors based on description and observation.” How do these types of research translate to your survey design and how do you analyze the data that comes from the survey?

What Is The Difference Between Quantitative and Qualitative Questions?

Quantitative questions focus on numbers and measurements such as scale and multiple choice questions. These questions are used when seeking to measure frequency and intensity of behaviors or experiences.

Example: “How many times per year do you change the air filter in your AC unit?”

Qualitative questions are used when seeking information that goes beyond numbers, such as attitudes and behaviors. These questions are gathering narrative information from respondents, seeking their thoughts and opinions. These questions commonly ask respondents to provide a written answer.

Example: “Can you describe your recent experience you had with our HVAC services?”

Each question type serves a different purpose to gather data. Another consideration is not only whether the question is qualitative or qualitative, but also, which question type best fits them to reach the information you are looking to gather.

To optimize your survey design, it’s important to address the specific goals you have in mind. Here are some guidelines for using each type of question effectively:

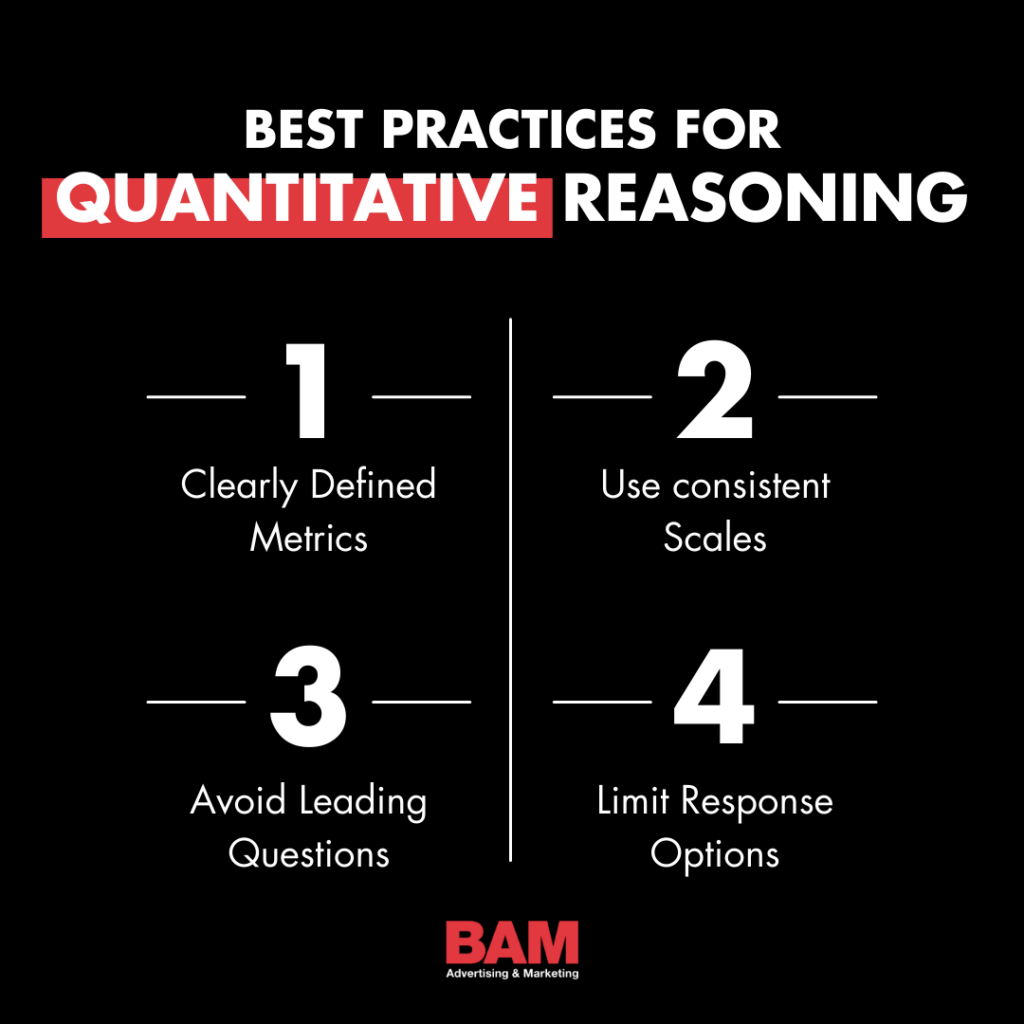

Best Practices for Quantitative Questions

- Clearly Defined Metrics: When crafting quantitative questions, ensure that your metrics are well-defined and relevant to your objectives. For example, instead of asking “How satisfied are you?”, provide a scale (e.g., 1-5) that allows respondents to specify their satisfaction levels with clarity.

- Use Consistent Scales: If your survey includes multiple quantitative questions, use consistent scales (such as Likert scales) throughout the survey. This consistency makes it easier for respondents to understand and for analysts to interpret the data.

- Avoid Leading Questions: Ensure that your questions are neutral and do not lead respondents to a particular answer. This helps in gathering authentic responses that accurately reflect opinions and experiences.

- Limit Response Options: While it’s important to provide enough options for respondents to express their views, avoid overwhelming them with too many possibilities. A short, well-defined list can often yield more reliable responses.

Best Practices for Qualitative Questions

When designing qualitative questions for surveys, especially in the context of lead generation and market research, it’s essential to follow best practices to elicit thoughtful and insightful responses. Here are some best practices for crafting effective qualitative questions:

- Be Clear and Concise: Ensure that your questions are straightforward and easy to understand. Avoid jargon or complex language that might confuse respondents.

- Use Open-Ended Questions: Encourage detailed responses by using open-ended questions that allow respondents to elaborate on their thoughts and feelings rather than just providing a yes/no answer.

- Focus on Specific Topics: Direct questions toward specific areas of interest related to your objectives. This helps in gathering relevant insights that can inform your marketing strategies.

- Encourage Personal Experiences: Frame questions in a way that prompts respondents to share their personal experiences or stories. For example, “Can you describe a time when you faced challenges with [specific product/service]?”

- Avoid Leading Questions: Ensure your questions do not lead the respondents to a particular answer. For instance, instead of asking, “How much do you love our product?” ask, “What are your thoughts on our product?”

- Include Probing Questions: Follow up on respondents’ initial answers with probing questions to gather deeper insights. For example, “Can you explain why that feature is important to you?”

- Limit the Number of Questions: To avoid survey fatigue, limit the number of qualitative questions. Focus on quality over quantity to encourage thoughtful responses.

- Test Your Questions: Before launching the survey, conduct a pilot test with a small group to identify any ambiguities or issues with the questions. This helps ensure clarity and effectiveness.

By employing these best practices, you can create qualitative questions that yield rich, actionable insights, aiding in your lead generation and content marketing efforts.

Analyzing Quantitative & Qualitative Data

Analyzing the survey data is the first step to taking the data and turning it into leads. This process begins with analyzing quantitative data first, as it is the most straightforward.

Analyzing Quantitative Survey Results

There are things that need to be considered when analyzing quantitative data. Including:

Size of the Quantitative Survey Data

How many people participated in the survey? Did they complete every single question? This is where it is important to pay close attention to the questions that were required or not required. This is because there are non-required questions that may have less responses than the required questions.

Cross- Tabulation & Filtering Quantitative Survey Results

Cross-tabulation is defined by Kent State University as “In a cross-tabulation, the categories of one variable determine the rows of the table, and the categories of the other variable determine the columns. The cells of the table contain the number of times that a particular combination of categories occurred. The “edges” (or “margins”) of the table typically contain the total number of observations for that category.”

By the analyzing phase of the survey process, you already know the audiences the survey was gathering information. Now, these audiences, or groups, can be organized with a method called ‘cross-tabulation’ to easily see how they’ve responded in the survey. For example, if you want to see how different customer segments—residential, commercial, and industrial—responded to the question of whether they would recommend your HVAC services, use cross-tabulation. This method allows you to break down response rates by subgroup:

From this table, you see that a majority of residential customers (85%) and commercial customers (70%) would recommend your services, but only 55% of industrial customers would. Analyzing other survey questions may help you understand why and how to improve for industrial clients.

In addition to using cross-tabulation to analyze quantitative data, filtering is another method to focus on a particular subgroup or audience, filtering out the rest. For example, you could look at responses from only large commercial clients and compare their satisfaction with smaller commercial clients. Remember, each filter or cross-tab reduces your sample size, so use a sample size calculator to ensure statistical significance.

Graphs & Quantitative Survey Data

Graphs are a powerful tool to visually demonstrate your survey results. Graphs make it simple to disseminate information that is easy for others to understand.

Benchmarking, Trending, & Comparative Quantitative Data

Benchmarking allows you to compare current data with past data or industry standards. For example, if last year’s satisfaction rate was 60%, a 75% rate this year indicates a 15% improvement. This trend analysis can help identify factors that contributed to the increase in satisfaction.

If you don’t have previous data, start collecting feedback to establish benchmarks for future comparison. Longitudinal data analysis can track changes over time, highlighting trends and areas for improvement.

Analyzing Qualitative Survey Results

Qualitative data analysis involves the identification, examination, and interpretation of patterns and themes in textual data, and determines how these patterns and themes help answer the questions at hand. There are a few ways to examine and organize your qualitative data.

Categorizing Qualitative Data

A good place to start when analyzing qualitative survey data is by creating categories for the questions to fall into. For example, if your survey asks about customer satisfaction with various aspects of your service, your preset categories might include:

- Installation Quality

- Maintenance Service

- Customer Support

- Pricing

- Timeliness

The initial categories chosen may change or have additions made as you sift through your data. When analyzing open-ended survey responses, it can be useful to count how often certain categories appear. Counting how many times a theme is mentioned can give you a rough idea of its importance. For example, if “customer service” is mentioned 50 times and “pricing” is mentioned 20 times, it suggests that customer service is a significant concern.You may be wondering how you can visualize this data when it is being categorized. Here is an example:

There also may be instances where there are connections between data. It is important to be able to understand and explain how or why categories may be related and what factors contribute to that relationship.

Descriptive Summaries for Qualitative Survey Responses

Creating summaries of qualitative questions makes going through the data much more digestible. This can be done by reading through the responses for a question and combining common thoughts and themes provided by respondents. These summaries can also include important or noteworthy quotes from open-ended questions. This is also a great time to make note of any findings that may be surprising or expected.

For example, if the question is “what areas do you think we could improve in our HVAC service?” The summary may be something like this: Customers often mentioned the quick response time and efficiency of the service. A typical response was, “They arrived on time and finished the job quickly without compromising quality.”

Generating High Quality Leads Using Survey Data

In today’s competitive business landscape, understanding your target audience is more crucial than ever. Surveys serve as a practical tool to gather vital insights about potential customers, preferences, and behaviors. This article explores how businesses can effectively use survey data to generate valuable leads that can help drive growth and success.

Survey Lead Magnet

Your survey’s lead magnet is where you will be capturing the survey respondents’ contact information. This can include their name, email, phone number, or company. To encourage participants to provide this information, offer an exclusive coupon or service. This is also a great time to give participants the option to sign-up for your business’s newsletter or email program. When a person is opting into your program, this is a high-quality lead, as this person is choosing to inquire more about your business and you’re providing them with a coupon to further guide them down the sales funnel into becoming a customer.

The Importance of Data-Driven Decisions

Before delving into the process of utilizing survey data, it’s essential to understand the importance of data-driven decision-making. By relying on accurate data, businesses can tailor their marketing strategies, product offerings, and customer service to meet specific needs, thereby enhancing customer satisfaction and loyalty.

Analyzing Survey Data

Once you have collected the survey responses, the next step is analyzing the data to extract valuable insights. Here’s how to effectively analyze your survey data:

1. Use Data Visualization Tools

Data visualization tools can help transform complex data into understandable formats such as charts and graphs. Tools like Tableau or Google Data Studio can highlight trends and patterns quickly, making it easier to derive meaning from your survey responses.

2. Segment Your Audience

Not all leads are created equal. By segmenting your audience based on responses, you can identify key demographics, interests, and behaviors that are most likely to convert. This segmentation allows for targeted marketing efforts that resonate more with specific groups.

3. Focus on Key Metrics

Identify and focus on key performance indicators (KPIs) that align with your business goals. Whether it’s response rates or customer satisfaction levels, measuring these metrics can help inform your lead generation strategies.

Crafting Targeted Marketing Campaigns With Your Survey Data

Armed with insights from your surveys, you can develop marketing campaigns that are relevant and engaging to your audience. Here’s how to translate survey data into effective marketing efforts:

Personalization: Use the information gathered to personalize your marketing messages. Personalized emails, targeted ads on social media platforms, and tailored content can significantly increase engagement and lead conversion rates.

Create Valuable Content: Surveys can highlight areas where your audience seeks more information or education. Use this data to create valuable content, such as ebooks, webinars, or how-to guides. Offering useful resources can position your brand as an industry authority and generate potential leads.

Offer Incentives: Sometimes, the best way to encourage survey participants to convert into leads is to offer incentives. Consider providing discounts, free trials, or exclusive content in exchange for their participation in your survey.

Follow Up and Nurture Leads

After generating leads from your survey data, it’s crucial for your sales team to follow up appropriately. Here are some strategies for nurturing these leads:

Create a Lead Scoring System: Develop a lead scoring system to prioritize sales team follow-ups based on user engagement and interest levels. Focus your resources on high-scoring leads who are more likely to convert.

Regular Communication: Maintain regular communication with your leads through newsletters, targeted email campaigns, and personalized follow-ups. Staying top-of-mind ensures that your brand remains relevant to potential customers.

Solicit Further Feedback: Once your leads have engaged with your products or services, continue the conversation. Solicit feedback to improve and refine your offerings, showing leads that you value their opinions and encouraging loyalty.

Proven Content Marketing and Lead Generation Strategies to Drive Growth

Utilizing survey data to generate leads is a powerful marketing strategy that can significantly impact your business growth. By carefully designing effective surveys, analyzing collected data, and crafting targeted marketing campaigns, you can attract, engage, and nurture leads that ultimately drive success. Embrace the power of data-driven insights and transform your lead generation efforts today.